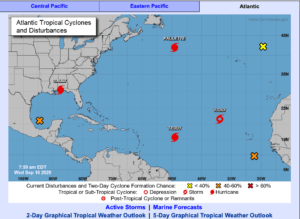

With countless storms and a hurricane churning in the Gulf of Mexico and the Atlantic Ocean, now is the perfect time to review your hurricane plan, homeowners insurance and shore up your home.

What many don’t realize is that with inflation, insurance costs more and covers less. The personal finance site and lender discovered that 86 percent of homeowners in hurricane-prone areas in the U.S. say they are prepared for a hurricane.

Yet the survey released in August also says that 1 in 3 homeowners haven’t made any preparations so far this hurricane season. (View full report: Hurricane Preparedness Survey)

Forty-five percent of homeowners in hurricane-prone states have no idea how much hurricane-related insurance coverage they need to be fully protected. Many underestimate the costs of a hurricane- or flood-related repairs, according to ValuePenguin.

Review your insurance and get up to speed on your coverage. Does your insurance include flood insurance, wind damage and other popular coverage areas?

While many homeowners in high-risk areas believe they’ll face flooding from hurricanes this year, ValuePenguin’s survey reports about a third falsely believe they’re covered under their insurance policy. Many renters also carry the same false belief about their coverage.

If it does, get familiar with your coverage limits and what you will need to document in case of damage. No one wants to submit a claim but knowing the process ahead of time will make things easier if your home or property is damaged.

Don’t Have Coverage?

You’re not alone. A lot of people forgo getting homeowners insurance and paying the premiums. Yes, it can be expensive, but the coverage does provide peace of mind.

In the middle of hurricane season, you can buy flood insurance 30 days in advance. Some states to impose a waiting period if you buy wind damage; however, most homeowners insurance already cover it.

If you are among the less than 10 percent of homeowners without property insurance, it’s good to know that insurers allow you to get wind damage as long as there isn’t a hurricane watch in effect.

Affordable Deductible

Filing a hurricane-related claim is based on the percentage of your home or property’s insured value. That needs to be assessed before your insurance coverage kicks in. That amount could range between 1 percent to 10 percent.

Opting for a lower deductible means you’ll pay more if you sustain damage. Many property owners don’t think they’ll ever have to submit a claim, but that’s a risky bet.

“People should never take a higher deductible than they can afford,” she says. “The amount you save in premiums is insignificant compared to the amount you would get at claim time,” stated Lynne McChristian, director of the Office of Risk Management and Insurance Research at the University of Illinois at Urbana-Champaign in an article for the New Valley Register.

If you do sustain damage, a good next step is reviewing your policy and claim options with a qualified attorney. Many will assess your insurance and help guide you through the process, ensuring your coverage needs are met.